Rush rec TDS meaning is a term often encountered in financial and business contexts, particularly when discussing tax compliance and revenue management. Whether you're a business owner, accountant, or simply someone interested in understanding financial terminology, this article will provide you with a comprehensive breakdown of what rush rec TDS means and why it matters. This concept plays a crucial role in ensuring that businesses adhere to tax regulations and maintain transparency in financial transactions.

In today's fast-paced business environment, staying compliant with tax laws is more important than ever. Rush rec TDS meaning refers to the process of deducting taxes at source during specific transactions. This mechanism helps governments ensure that taxes are collected efficiently and reduces the burden of tax payments for individuals and businesses alike.

As we delve deeper into this topic, you'll gain insights into the intricacies of rush rec TDS, its applications, and how it impacts various stakeholders. By the end of this article, you'll have a solid understanding of this financial concept and how it fits into the broader framework of tax compliance.

Read also:Nba Youngboy Net Worth Exploring The Rise Of A Hiphop Phenomenon

What is Rush Rec TDS?

Rush rec TDS, or Tax Deducted at Source, refers to the process where a specific percentage of money is withheld from payments made during certain transactions. This deduction is mandated by tax authorities to ensure that taxes are collected at the time of transaction, rather than at a later date. The concept of rush rec TDS is widely used in countries like India, where it serves as a critical tool for tax collection.

Rush rec TDS is applicable to a variety of financial transactions, including but not limited to:

- Interest payments on fixed deposits

- Rent payments exceeding a certain threshold

- Freelance or professional service payments

- Commission payments

By implementing rush rec TDS, governments can streamline tax collection processes and minimize the risk of tax evasion. This system ensures that both payers and recipients comply with tax regulations, fostering a more transparent and accountable financial ecosystem.

How Does Rush Rec TDS Work?

The mechanics of rush rec TDS involve a straightforward process where the payer deducts a specified percentage of the payment as tax and remits it to the government. This deduction is based on predefined rates set by the tax authorities. For instance, if an individual earns interest on a fixed deposit, the bank may deduct a certain percentage of the interest as TDS before crediting the remaining amount to the account holder.

Key Components of Rush Rec TDS

To better understand how rush rec TDS operates, let's break it down into its key components:

- Payer: The entity making the payment, such as a company or individual.

- Recipient: The party receiving the payment, such as an employee or service provider.

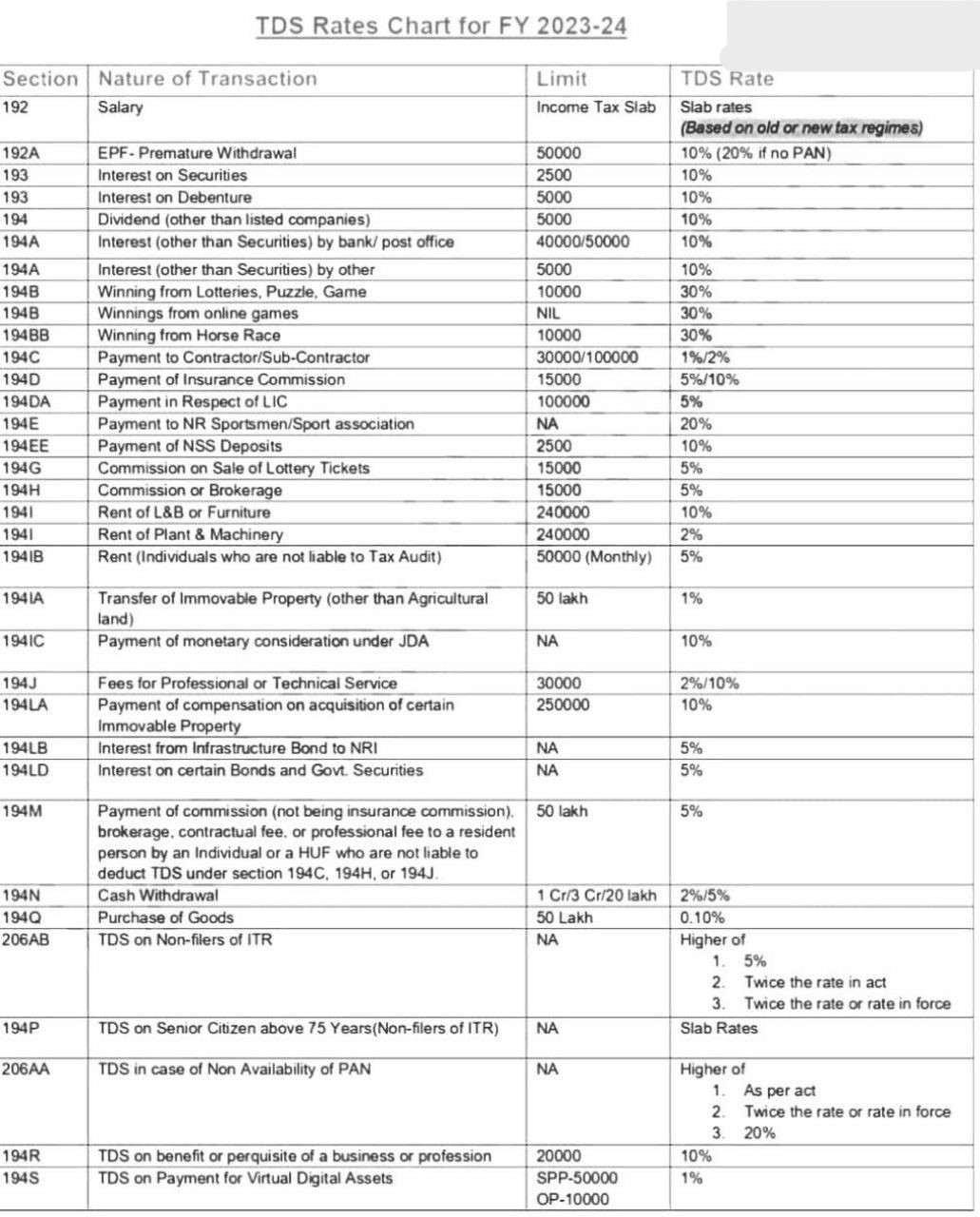

- TDS Rate: The percentage of the payment that must be deducted as tax, as determined by tax regulations.

- TDS Certificate: A document issued by the payer to the recipient, detailing the amount of TDS deducted and the payment made.

Understanding these components is essential for both payers and recipients to ensure compliance with rush rec TDS requirements.

Read also:Kimberly Dos Ramos Rising Star In The World Of Entertainment

Types of Transactions Covered Under Rush Rec TDS

Rush rec TDS applies to a wide range of financial transactions, each governed by specific rules and thresholds. Below are some of the most common types of transactions where rush rec TDS is applicable:

Rent Payments

When individuals or businesses pay rent exceeding a certain limit, rush rec TDS is typically deducted. This ensures that landlords pay their due taxes on rental income. For example, in India, if the annual rent exceeds ₹2,40,000, TDS must be deducted at 5%.

Freelance and Professional Services

Freelancers and professionals providing services such as consulting, legal advice, or technical support may also be subject to rush rec TDS. The payer is responsible for deducting the appropriate TDS rate and remitting it to the government.

Interest Payments

Banks and financial institutions often deduct rush rec TDS from interest payments on fixed deposits, savings accounts, and other investment instruments. This ensures that depositors comply with tax obligations on their earnings.

Benefits of Rush Rec TDS

The implementation of rush rec TDS offers several advantages for both individuals and businesses:

- Efficient Tax Collection: Rush rec TDS ensures that taxes are collected promptly, reducing the likelihood of non-compliance.

- Reduced Tax Burden: By deducting taxes at source, individuals and businesses can avoid large tax payments at the end of the financial year.

- Transparency: Rush rec TDS promotes transparency in financial transactions, making it easier for tax authorities to monitor compliance.

These benefits highlight the importance of rush rec TDS in maintaining a fair and equitable tax system.

Challenges and Considerations

While rush rec TDS is a valuable tool for tax compliance, there are certain challenges and considerations to keep in mind:

Complexity of Regulations

Tax regulations governing rush rec TDS can be complex and vary depending on the type of transaction and jurisdiction. Businesses and individuals must stay updated on these regulations to ensure compliance.

Refund Process

In some cases, recipients may be eligible for TDS refunds if the taxes deducted exceed their actual tax liability. Navigating the refund process can be time-consuming and requires careful documentation.

Statistical Insights on Rush Rec TDS

According to data from the Indian Income Tax Department, rush rec TDS contributes significantly to the country's tax revenue. In the financial year 2022-2023, TDS collections accounted for approximately 40% of the total direct tax revenue. This statistic underscores the importance of rush rec TDS in supporting government finances and funding public services.

Case Studies and Examples

To illustrate the practical application of rush rec TDS, let's examine a few case studies:

Case Study 1: Rent Payments

Mr. Sharma pays ₹30,000 per month in rent to his landlord. Since the annual rent exceeds ₹2,40,000, Mr. Sharma is required to deduct 5% TDS from the rent payments and remit it to the government. This ensures that the landlord complies with tax obligations on his rental income.

Case Study 2: Freelance Services

Ms. Patel, a freelance graphic designer, receives payments from clients for her services. Her clients deduct rush rec TDS at the applicable rate before making payments. This simplifies Ms. Patel's tax filing process, as the taxes are already accounted for.

Best Practices for Rush Rec TDS Compliance

To ensure compliance with rush rec TDS regulations, businesses and individuals should follow these best practices:

- Maintain accurate records of all transactions subject to TDS.

- Stay updated on changes to TDS rates and regulations.

- Issue TDS certificates promptly to recipients.

- File TDS returns regularly and on time.

Adhering to these practices will help minimize the risk of penalties and ensure smooth tax compliance.

Conclusion

Rush rec TDS meaning is a critical concept in the realm of tax compliance and revenue management. By understanding its mechanics, benefits, and challenges, individuals and businesses can navigate the complexities of tax regulations more effectively. This article has provided a comprehensive overview of rush rec TDS, including its applications, statistical insights, and best practices for compliance.

We encourage readers to share their thoughts and experiences in the comments section below. Additionally, feel free to explore other articles on our website for more insights into financial topics. Together, let's build a more informed and compliant financial community!

Table of Contents