Understanding Rush Rec TDS meaning is essential for anyone involved in financial transactions, particularly in the context of tax compliance and record-keeping. In today’s financial landscape, terms like TDS, Rec, and Rush often appear in discussions about tax deductions, payments, and regulatory compliance. This article will delve into the nuances of Rush Rec TDS meaning, ensuring you have a comprehensive understanding of its implications.

Whether you're a business owner, an employee, or a financial professional, knowing the Rush Rec TDS meaning can help you stay compliant with tax regulations and avoid potential penalties. This term refers to the process of deducting tax at source, a crucial aspect of financial management in many countries.

In this article, we will explore the Rush Rec TDS meaning in detail, breaking down its components and explaining how it applies to various financial scenarios. By the end of this guide, you'll have a clearer picture of how this concept impacts your financial activities and how you can ensure compliance.

Read also:Ocean Of Pdf Your Ultimate Guide To Free Ebooks And Digital Literature

Table of Contents

- What is Rush Rec TDS?

- Components of Rush Rec TDS

- Importance of TDS in Financial Transactions

- How Does Rush Rec TDS Work?

- Benefits of Rush Rec TDS

- Common Misconceptions About Rush Rec TDS

- Legal Compliance and Rush Rec TDS

- Challenges in Implementing Rush Rec TDS

- Tips for Effective Rush Rec TDS Management

- Future Trends in Rush Rec TDS

What is Rush Rec TDS?

Rush Rec TDS meaning refers to the process of deducting tax at source (TDS) during financial transactions. TDS, or Tax Deducted at Source, is a method of collecting income tax at the point where income is generated. The term "Rush Rec" is often used in specific contexts, such as payment processing systems or software platforms that handle tax deductions.

This concept is vital for businesses and individuals alike, as it ensures that taxes are collected efficiently and in compliance with legal requirements. Understanding the Rush Rec TDS meaning helps stakeholders navigate the complexities of tax compliance more effectively.

Components of Rush Rec TDS

Rush

The term "Rush" in Rush Rec TDS refers to the urgency or immediacy of the tax deduction process. It emphasizes the importance of timely compliance with tax regulations. In practical terms, Rush indicates the need for swift action in deducting and remitting taxes to the appropriate authorities.

Rec

Rec, short for "Recipient," refers to the party receiving the payment. In the context of Rush Rec TDS, the recipient is the individual or entity that is subject to tax deductions. This could be an employee, contractor, or vendor, depending on the nature of the transaction.

TDS

TDS, or Tax Deducted at Source, is the core component of Rush Rec TDS. It involves deducting a specified percentage of the payment as tax before transferring the remaining amount to the recipient. This method simplifies tax collection and ensures that the government receives its share promptly.

Importance of TDS in Financial Transactions

TDS plays a crucial role in financial transactions by ensuring that taxes are collected at the source, reducing the burden on taxpayers to pay taxes later. This system helps prevent tax evasion and ensures a steady flow of revenue for the government.

Read also:Mya Lynn Lesnar The Rising Star In The Spotlight

For businesses, implementing TDS as part of their financial processes demonstrates a commitment to legal compliance and responsible financial management. It also helps build trust with clients and partners, as it shows that the company adheres to regulatory standards.

How Does Rush Rec TDS Work?

The Rush Rec TDS process involves several key steps:

- Identifying transactions that are subject to TDS.

- Determining the applicable TDS rate based on the type of transaction and the recipient's tax status.

- Deducting the specified percentage of the payment as TDS.

- Remitting the deducted tax to the appropriate tax authority within the specified timeline.

- Providing the recipient with a TDS certificate, which details the amount of tax deducted and the payment made.

By following these steps, businesses and individuals can ensure compliance with TDS regulations and avoid potential penalties.

Benefits of Rush Rec TDS

Implementing Rush Rec TDS offers several advantages, including:

- Efficient Tax Collection: TDS ensures that taxes are collected at the source, reducing the likelihood of non-compliance.

- Reduced Administrative Burden: Businesses can streamline their tax processes by automating TDS calculations and remittances.

- Improved Cash Flow Management: Deducting taxes upfront helps businesses manage their cash flow more effectively.

- Enhanced Legal Compliance: Adhering to TDS regulations demonstrates a commitment to legal standards and builds trust with stakeholders.

Common Misconceptions About Rush Rec TDS

Despite its importance, there are several misconceptions surrounding Rush Rec TDS:

- Myth: TDS Only Applies to Employees: While TDS is commonly associated with salary payments, it also applies to various other transactions, such as payments to contractors and vendors.

- Myth: TDS Deduction Exempts Further Tax Payments: Deducting TDS does not necessarily mean that no further tax is due. Individuals and businesses may still need to file tax returns and pay additional taxes if applicable.

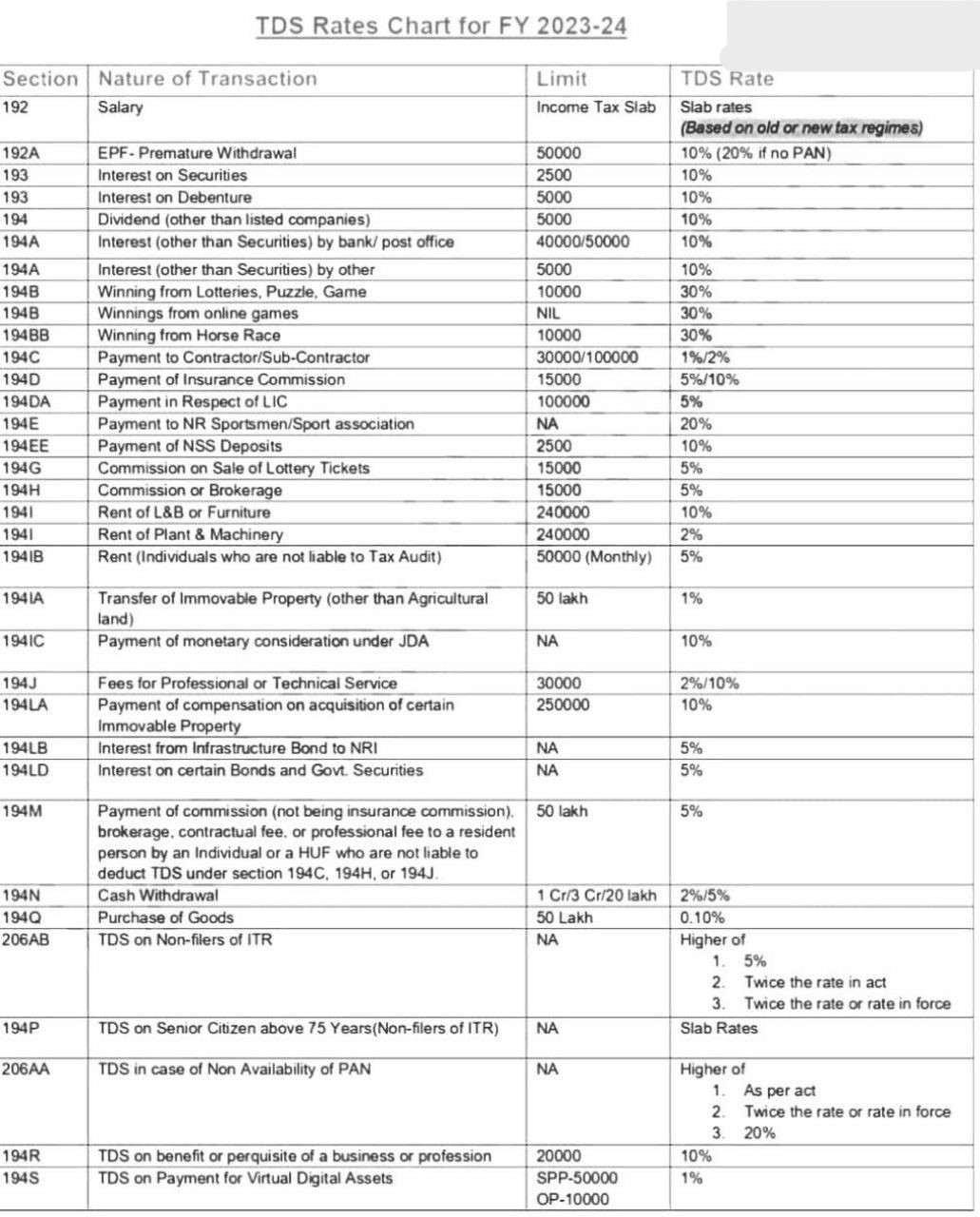

- Myth: TDS Rates Are Uniform: TDS rates vary depending on the type of transaction and the recipient's tax status. It's essential to understand the specific rates applicable to each scenario.

Legal Compliance and Rush Rec TDS

Ensuring legal compliance with Rush Rec TDS is critical for avoiding penalties and maintaining a good reputation. Businesses must adhere to the following guidelines:

- Register with the appropriate tax authorities to obtain a TAN (Tax Deduction and Collection Account Number).

- File regular TDS returns, detailing all deductions and remittances made during the specified period.

- Issue TDS certificates to recipients within the stipulated timeframe.

Failure to comply with these requirements can result in fines, interest charges, and other legal consequences.

Challenges in Implementing Rush Rec TDS

While Rush Rec TDS is a valuable tool for tax compliance, there are several challenges to its implementation:

- Complex Regulations: Tax laws and regulations can be complex and subject to frequent changes, making it difficult for businesses to stay updated.

- Technical Issues: Automating TDS processes requires robust software systems, which can be costly and time-consuming to implement.

- Human Error: Manual calculations and record-keeping can lead to errors, resulting in non-compliance and potential penalties.

Addressing these challenges requires a combination of technological solutions, training, and regular updates on regulatory changes.

Tips for Effective Rush Rec TDS Management

To manage Rush Rec TDS effectively, consider the following tips:

- Invest in reliable accounting software that automates TDS calculations and filings.

- Train employees on TDS regulations and processes to minimize errors and ensure compliance.

- Regularly review and update your TDS procedures to align with changing regulations.

- Seek professional advice from tax experts to address complex scenarios and ensure adherence to legal requirements.

Future Trends in Rush Rec TDS

The future of Rush Rec TDS is likely to be shaped by advancements in technology and changes in tax regulations. Some key trends to watch include:

- Increased Automation: The use of AI and machine learning in TDS processes will enhance accuracy and efficiency.

- Digitization of Records: Moving towards digital TDS certificates and filings will streamline processes and reduce paperwork.

- Global Harmonization: Efforts to standardize TDS regulations across jurisdictions may simplify cross-border transactions.

Staying informed about these trends will help businesses adapt to the evolving landscape of tax compliance.

Conclusion

In conclusion, understanding Rush Rec TDS meaning is crucial for anyone involved in financial transactions. By grasping the components, benefits, and challenges of this concept, you can ensure compliance with tax regulations and avoid potential penalties. We encourage you to take action by implementing the tips provided in this article and staying updated on future trends in TDS management.

Feel free to leave a comment or share this article with others who may find it useful. For more insights into financial management and tax compliance, explore our other articles on the site.

References

This article draws on information from reputable sources such as government tax authorities, financial publications, and expert analyses. For further reading, consider exploring resources like the IRS website, the World Bank, and industry-specific journals.